OpenAI’s Hardware Play: Why a 2026 Device Could Change How We Live with AI

A little of the future just walked onto the stage: OpenAI says its first consumer device is on track for the second half of 2026. That short sentence—uttered by Chris Lehane at an Axios event in Davos—does more than announce a product timeline. It signals a strategic shift for the company that built ChatGPT: from cloud‑first software maker to contender in the messy, expensive world of physical consumer hardware.

The hook

Imagine an always‑available, pocketable AI that understands context instead of just answering queries—a device designed by creative minds who shaped the modern smartphone look and feel. That’s the ambition flying around today. It’s tantalizing, but it also raises familiar questions: privacy, battery life, compute costs, and whether consumers really want yet another connected gadget.

What we know so far

- OpenAI’s timeline: executives have told reporters they’re “looking at” unveiling a device in the latter part of 2026. More concrete plans and specs will be revealed later in the year. (Axios) (axios.com)

- Design pedigree: OpenAI’s hardware push follows its acquisition/partnerships with design talent associated with Jony Ive (the former Apple design chief), suggesting a heavy emphasis on industrial design and user experience. (axios.com)

- Rumors and supply chain signals: reporting from suppliers and industry outlets has pointed to small, possibly screenless form factors (wearable or pocketable), engagement with Apple‑era suppliers, and various prototypes from earbuds to pin‑style devices. Timelines in some reports stretch into late 2026 or 2027 depending on hurdles. (tomshardware.com)

Why this matters beyond a new gadget

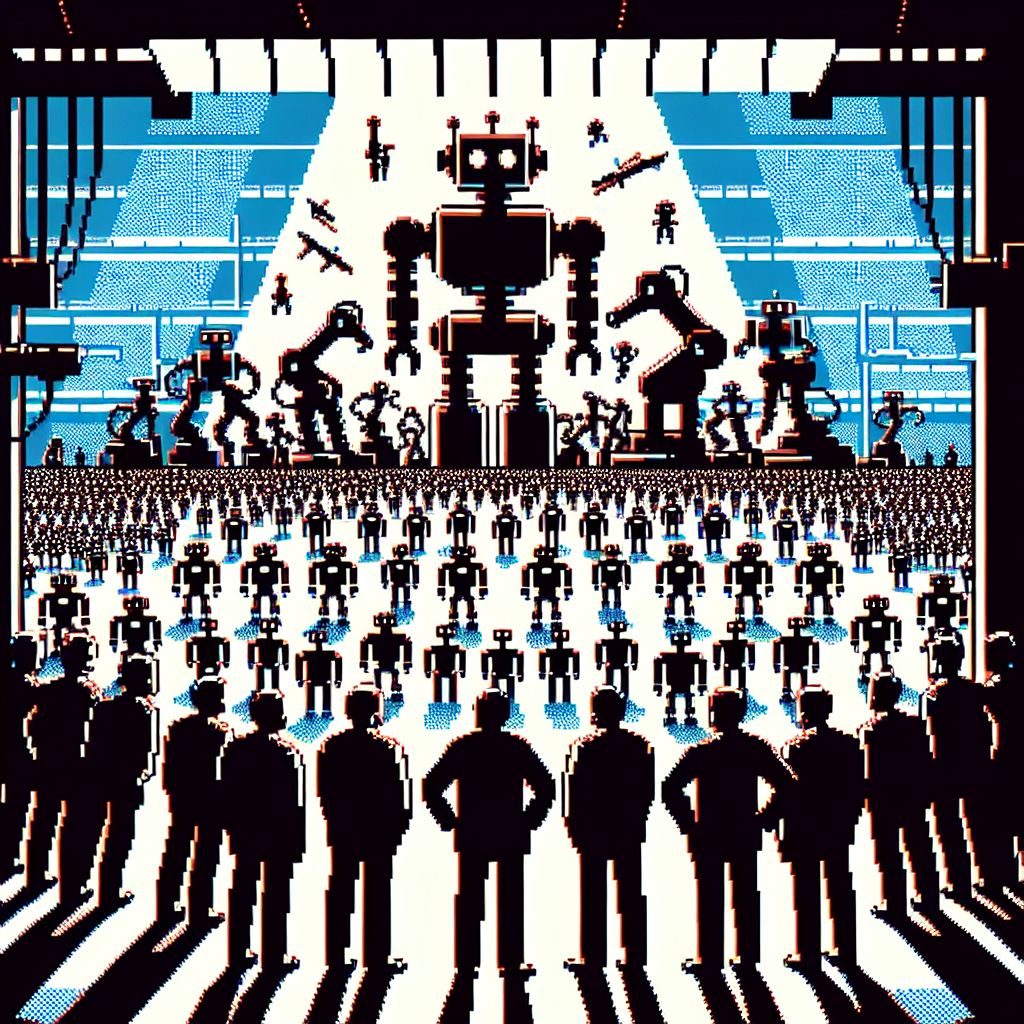

- Productization of advanced LLMs: Turning a model into a responsive, always‑on product requires different engineering priorities—latency, offline inference, secure context retention, and efficient wake‑word detection. A working device would be one of the first mainstream bridges between large multimodal models and daily, ambient interactions.

- Platform power and partnerships: If OpenAI ships hardware, it won’t just sell a device—it will create another platform for models, apps, and integrations. That has implications for existing tech partnerships (including those with cloud providers and phone makers) and competition with companies that already own both hardware and ecosystems.

- Design as differentiation: Pairing top‑tier AI with high‑end design could reshape expectations. People tolerated clunky early smart speakers and prototypes; a device with compelling industrial design and thoughtful UX could accelerate adoption.

- Privacy and regulation: An always‑listening, context‑aware device intensifies privacy scrutiny. How data is processed (on‑device vs. cloud), what’s retained, and how transparent the device is about listening will likely determine public and regulatory reception.

Opportunities and risks

-

Opportunities

- More natural interaction: voice and ambient context could make AI feel less like a search box and more like a helpful companion.

- New experiences: context memory and multimodal sensors (audio, possibly vision) could enable truly proactive assistive features.

- Market differentiation: OpenAI’s brand and model strength, combined with great design, could attract buyers dissatisfied with current assistants.

-

Risks

- Compute and cost: serving powerful models at scale (especially if interactions rely on cloud inference) could be prohibitively expensive or require compromises in performance.

- Privacy backlash: always‑on sensors and context retention will invite scrutiny and could deter mainstream uptake unless privacy is baked in and clearly communicated.

- Hardware pitfalls: manufacturing, supply chain, battery life, and durability are areas where software companies often stumble.

- Ecosystem friction: device makers and platform owners may be wary of a third‑party assistant competing on their hardware.

What to watch in 2026

- Concrete specs and pricing: Are we seeing a $99 companion device or a premium $299+ product? Price frames adoption potential.

- Architecture choices: How much processing happens on device versus in the cloud? That will reveal tradeoffs OpenAI is willing to make on latency, cost, and privacy.

- Integrations and partnerships: Will it be tightly integrated with phones/OSes, or positioned as a neutral companion that works across platforms?

- Regulatory and privacy disclosures: Transparent, simple explanations of how data is used will be crucial to avoid regulatory headaches and consumer distrust.

A few comparisons to keep in mind

- Humane AI Pin and Rabbit R1 showed the appetite—and the pitfalls—for new form factors that try to shift interactions away from phones. OpenAI has stronger model tech and deeper user familiarity with ChatGPT, but hardware execution is a new test.

- Apple, Google, Amazon: each company already mixes hardware, software, and cloud in distinct ways. OpenAI’s entrance could disrupt how voice and ambient assistants are designed and monetized.

My take

This isn’t just another gadget announcement. If OpenAI ships a polished, privacy‑conscious device that leverages its models intelligently, it could nudge the market toward more ambient AI experiences—where the interaction model is context and conversation, not tapping apps. But the company faces steep non‑AI challenges: supply chains, cost control, battery engineering, and the thorny politics of always‑listening products. Success will depend less on model size and more on product judgment: what to process locally, what to ask the cloud, and how to earn user trust.

Sources

-

Exclusive: OpenAI aims to debut first device in 2026 — Axios.

https://www.axios.com/2026/01/19/openai-device-2026-lehane-jony-ive. (axios.com) -

OpenAI is reportedly poaching Apple talent to build its first consumer hardware device — Tom’s Hardware.

https://www.tomshardware.com/tech-industry/openai-reportedly-poaching-apple-talent-to-build-first-consumer-device. (tomshardware.com) -

Big OpenAI leak claims the ChatGPT maker is developing an earbud-style wearable — TechRadar.

https://www.techradar.com/ai-platforms-assistants/openai/big-openai-leak-claims-the-chatgpt-maker-is-developing-an-earbud-style-wearable-with-a-surprising-twist. (techradar.com)

Final thoughts

We’re at an inflection point: combining the conversational strengths of modern LLMs with thoughtful hardware could make AI feel like a native part of daily life instead of an app you visit. That’s exciting—but the real test will be whether OpenAI can translate AI brilliance into a device people actually want to live with. The second half of 2026 may give us the answer.

Related update: We recently published an article that expands on this topic: read the latest post.

Related update: We recently published an article that expands on this topic: read the latest post.

Related update: We recently published an article that expands on this topic: read the latest post.