Tyquan Thornton Shines in Chiefs’ Victory: A Night to Remember

What a night it was for Tyquan Thornton! In the Chiefs’ recent win over the Giants, the young wide receiver not only showcased his incredible talent but made NFL headlines for a moment that even left Patrick Mahomes, the star quarterback, impressed—despite not being the one to throw the pass. Let’s dive into how Thornton emerged as a standout player and what it means for both the Chiefs and his future in the league.

Context: A Rising Star in the NFL

Tyquan Thornton, drafted by the Chiefs this past season, has been steadily making his mark in the NFL. Known for his speed and agility, Thornton’s potential was evident even in the pre-season. However, it was during this recent game that fans got a taste of just how impactful he could be on the field. With the Chiefs coming off a series of ups and downs, this victory against the Giants was crucial for team morale—and Thornton played a key role.

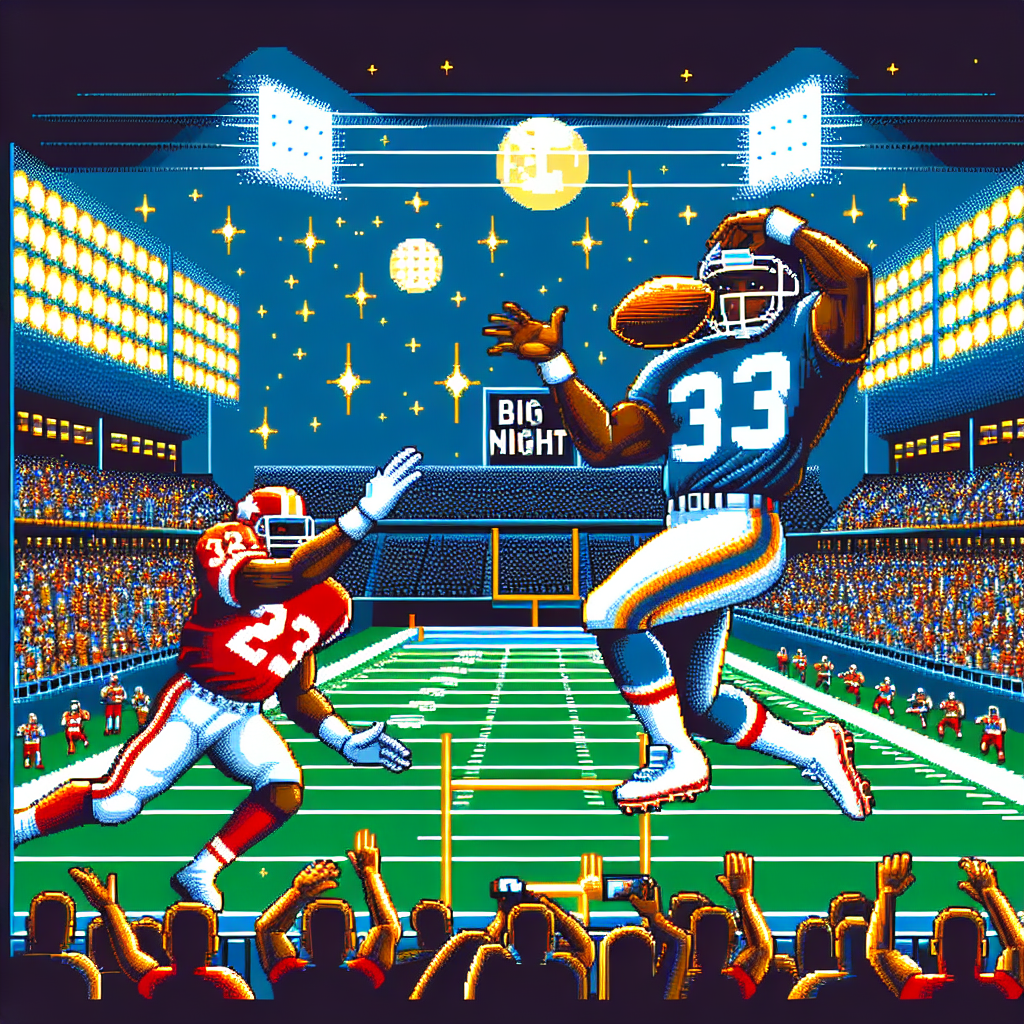

In a game that featured intense moments and strategic plays, Thornton led the team with five catches for 71 yards, including a jaw-dropping touchdown. His spectacular catch at the 1-yard line was one of the highlights of the season, demonstrating not just his physical skills but also his ability to perform under pressure.

Key Takeaways

– Outstanding Performance: Thornton led the Chiefs in receiving yards and catches, proving that he can be a reliable target for Mahomes. – Spectacular Catch: The highlight of the night was his incredible catch at the 1-yard line, showcasing his athleticism and concentration. – Building Chemistry: As Thornton continues to develop his relationship with Mahomes, fans can expect more exciting plays and a potent offensive strategy from the Chiefs. – Future Potential: This performance could mark a turning point in Thornton’s career, establishing him as a key player for the Chiefs moving forward. – Team Morale Boost: The victory not only solidified their position in the league but also rejuvenated the team’s confidence, with Thornton at the forefront.

Conclusion: A Bright Future Ahead

Tyquan Thornton’s breakout performance is a testament to the hard work and dedication that young athletes put into their game. As he continues to grow within the Chiefs’ system, fans can look forward to witnessing more electrifying moments on the field. This game wasn’t just about one player shining; it was a reminder of the collective effort it takes to win in the NFL. With players like Thornton stepping up, the future looks bright for the Chiefs.

Sources

– “Tyquan Thornton’s big night included catching a pass Patrick Mahomes didn’t throw to him – NBC Sports” (https://www.nbcsports.com/nfl)

In the world of sports, moments like these are what keep fans coming back for more. Let’s see what Thornton and the Chiefs will bring to the table next week!

Related update: We recently published an article that expands on this topic: read the latest post.

Related update: We recently published an article that expands on this topic: read the latest post.