The $14 Trillion US Stock Rally is Seeking a Fed Cut Playbook - Bloomberg.com | Analysis by Brian Moineau

Title: Navigating the Stock Market's $14 Trillion Journey: What Will the Fed Do Next?

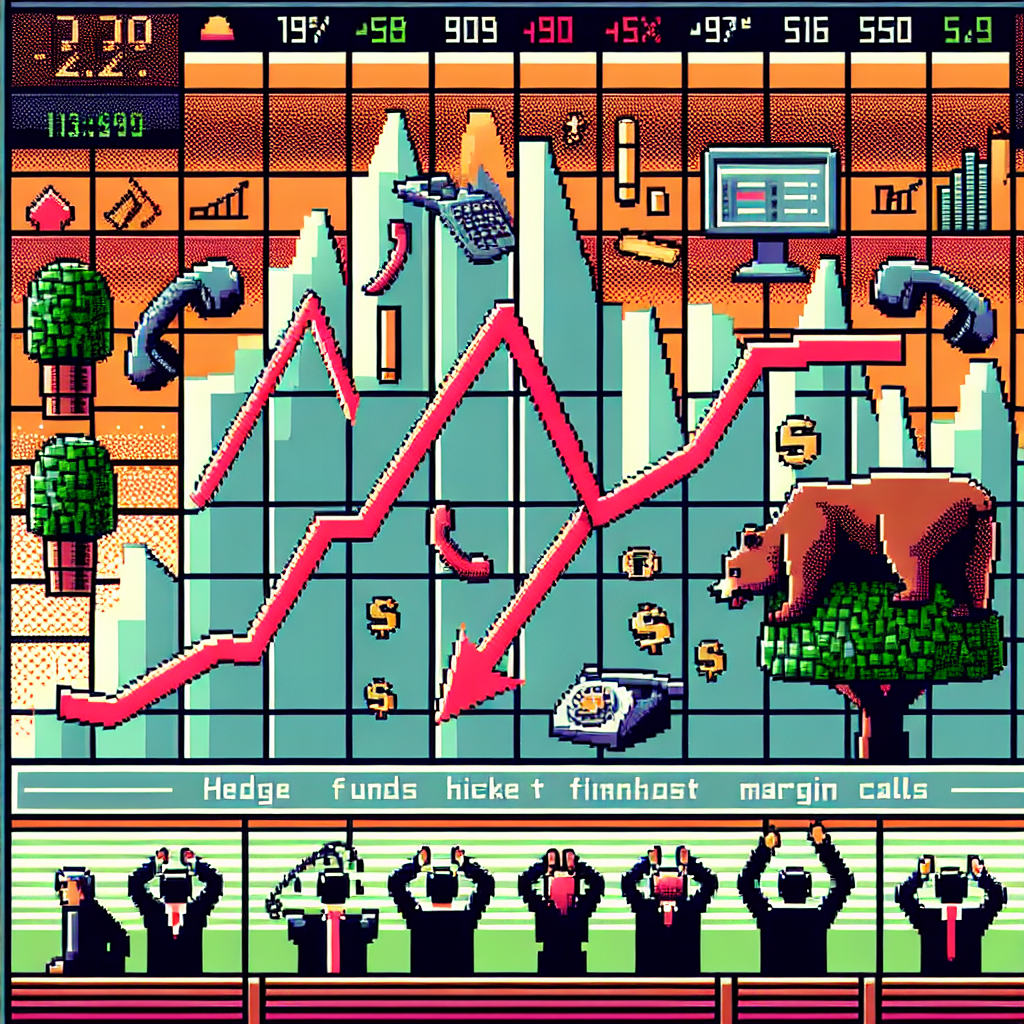

As the curtain rises on another pivotal week for the financial world, investors are on the edge of their seats, eagerly anticipating the Federal Reserve's next move. The backdrop? A staggering $14 trillion rally that has propelled U.S. stocks to record highs. But as with any great performance, this rally is approaching an inflection point, with the market eagerly awaiting the Fed's next act: a potential cut in interest rates.

The Plot So Far: A Rally of Epic Proportions

The U.S. stock market has been on an exhilarating ride, reaching new heights and capturing the imagination of investors worldwide. The rally's magnitude is nothing short of spectacular, with $14 trillion added to the value of U.S. stocks. This surge has been driven by a combination of strong corporate earnings, technological innovation, and investor optimism.

But like any good story, there's a twist. As we approach the Federal Reserve's long-awaited monetary policy meeting, investors are at a crossroads. Will the Fed cut interest rates to keep the rally alive, or will they hold steady, introducing uncertainty into the market narrative?

The Fed's Role: The Decision-Makers in the Spotlight

The Federal Reserve, led by Chairman Jerome Powell, finds itself in a familiar yet challenging position. The market's expectations are clear: a rate cut would likely extend this bull market's life, providing a fresh jolt of energy. However, navigating the delicate balance between fostering economic growth and controlling inflation is no small feat.

To get a sense of the Fed's potential moves, it's worth considering their recent history. In 2019, the Fed cut rates three times in response to global economic uncertainties and trade tensions. The move was seen as a preemptive strike to sustain the U.S. economic expansion. Fast forward to today, and while inflation concerns have emerged, the overarching priority remains economic stability.

Connecting the Dots: A Global Perspective

This U.S. stock market rally isn't happening in a vacuum. Across the globe, other central banks are also grappling with similar decisions. The European Central Bank, for instance, has maintained a dovish stance, signaling the possibility of further easing to combat economic slowdown in the Eurozone. Meanwhile, the Bank of Japan continues its ultra-loose monetary policy, battling persistent deflationary pressures.

Moreover, the geopolitical landscape plays a crucial role. Trade relations, particularly between the U.S. and China, have shown signs of improvement, providing a sense of optimism. However, other global tensions, such as the ongoing energy crisis and political uncertainties, continue to cast shadows on the economic horizon.

The Lighter Side: A Financial Soap Opera

As we wait with bated breath for the Fed's decision, it's hard not to see this as a financial soap opera of sorts—complete with twists, turns, and cliffhangers. The stock market's journey has been a rollercoaster, thrilling and sometimes nerve-wracking. Investors, analysts, and everyday folks alike are all part of this unfolding drama, each with their own theories and predictions.

In the spirit of keeping it light, perhaps we can draw a parallel to the world of sports. Just as a coach must decide the best strategy for the big game, the Fed must carefully choose its playbook. Will they opt for an aggressive offense with a rate cut, or play it safe and maintain the status quo? Only time will tell.

Final Thoughts: The Story Continues

As we move forward, one thing is certain: the financial world will be watching closely. The Fed's decision will undoubtedly shape the next chapter of this market rally. Whether you're a seasoned investor or just someone keeping an eye on the headlines, this is a story worth following.

In the grand theater of finance, the Fed's decision is just one act in an ongoing saga. The market will continue to evolve, driven by innovation, global dynamics, and the ever-present human factor of optimism and fear. So, grab your popcorn, sit back, and enjoy the show—it's bound to be an exciting ride.

Read more about AI in Business