Amazon’s Hidden Outlet Is the Black Friday Gold Mine You Didn’t Know About

Black Friday and Cyber Monday can feel like a frantic sprint — but there’s a quieter lane that’s suddenly packed with bargains: Amazon’s Outlet. Think top kitchen brands, popular sneaker lines and useful home gear marked down to eye-catching prices (some starting as low as $7). If you like scoring quality items without wrestling through the noisy front-page flash sales, the Outlet is worth a bookmark this holiday season. (eatingwell.com)

Why the Outlet matters right now

- Amazon Outlet aggregates overstock, refurbished and clearance items from across Amazon’s catalog, which means brand-name gear shows up at steep markdowns without the flash-sale theater. That makes it a great place to find practical gifts or upgrade gear on a budget. (eatingwell.com)

- During the early Black Friday/Cyber Monday window this year, a wave of discounts hit kitchen and home categories: KitchenAid mixers and attachments, Nutribullet and Vitamix blenders, Wüsthof and Cuisinart knives and cookware, plus Adidas and New Balance footwear. Prices and inventory rotate fast, so patience and quick clicks pay off. (eatingwell.com)

Quick wins you might find

- Stand mixers, hand mixers and popular KitchenAid attachments at meaningful discounts — useful for bakers and gift givers. (eatingwell.com)

- Kitchen tools and cutlery: Wüsthof knife sets, OXO utensils and Cuisinart gadgets frequently appear with substantial cuts. (eatingwell.com)

- Small appliances: high-capacity blenders and air fryers from Nutribullet, Ninja and Vitamix show up at sale prices during this period. (allrecipes.com)

- Footwear and apparel from Adidas, New Balance and other brands at outlet prices starting near single digits on smaller items. (eatingwell.com)

How to shop the Outlet like a pro

- Check the Outlet early and often. Inventory is volatile — the best deals can disappear within hours. Set aside a short window each day during the sale period to scan for items on your list. (eatingwell.com)

- Use search filters and brand pages. Narrowing by brand (KitchenAid, Wüsthof, Adidas, etc.) and by category (kitchen, shoes, home) speeds discovery. (owler.com)

- Compare prices. Sometimes a “deal” looks good in the Outlet but similar or better discounts appear on the manufacturer’s site or Amazon’s main deals hub. Do a quick price-check before you add to cart. (tomsguide.com)

- Watch condition labels. Outlet listings can include new, open-box, or refurbished items. Read the condition notes and return policies before buying — for appliances and knives, condition and included accessories matter. (eatingwell.com)

- Check seller and fulfillment. Items sold and shipped by Amazon often have simpler return experiences. Third-party sellers can be fine, but scan ratings and return terms. (eatingwell.com)

What to prioritize (and what to skip)

- Prioritize: durable, high-use items where brand and build quality matter — stand mixers, blenders, quality knives, cast-iron or stainless pans. Those items age well and the Outlet’s discounts can give you near–clearance pricing on long-lasting gear. (eatingwell.com)

- Skip or pause: trendy single-use gadgets or heavily discounted fashion with unclear sizing/return language. If the listing lacks detailed photos or condition descriptions, wait or look for a better-specified listing. (owler.com)

A few deal examples spotted in the run-up to Black Friday

- KitchenAid stand mixers and smaller KitchenAid appliances appeared at lower-than-typical sale prices — good options for bakers who can’t bear to wait for doorbuster chaos. (tomsguide.com)

- Blenders from Nutribullet and Vitamix, and multi-use appliances (air fryers, combo ovens) showed steep discounts across Amazon’s deals ecosystem, sometimes mirrored in the Outlet. (allrecipes.com)

- Footwear: select Adidas and New Balance models and other casual shoes were included in Outlet markdowns, especially in common sizes and last-season colors. (eatingwell.com)

Smart risks and return-readiness

- High-dollar appliances: if you buy refurbs or open-box appliances, verify warranty transferability and what’s covered. Many refurbs come with limited warranties, so document serial numbers and seller info. (eatingwell.com)

- Knives and sharp tools: ensure listings make clear whether a full set, block, or single knife is included; check return policy because knives are a hygiene/inspection-sensitive category. (owler.com)

My take

The Amazon Outlet is the kind of shopping secret that rewards a bit of effort. It’s not always the absolute lowest price across every product, but for practical, high-quality kitchen gear and steady-use household items, it surfaces genuinely useful discounts with fewer gimmicks. If you’re gift-curating or upgrading tools for your kitchen this season, it’s a calmer, cleverer route than waiting on headline Black Friday frenzy. (eatingwell.com)

Sources

Related update: We recently published an article that expands on this topic: read the latest post.

A high-stakes hire, seized laptops, and the geopolitics of chips

An image of a pair of agents quietly removing computers from an executive’s home feels like a spy novel — until you remember this is about the tiny transistors that run the modern world. In late November 2025, Taiwan prosecutors executed search warrants at the homes of Wei-Jen Lo, a recently rehired Intel executive and former long-time TSMC senior vice president. Investigators seized computers, USB drives and other materials as part of a probe launched after TSMC sued Lo, alleging possible transfer or misuse of trade secrets. (investing.com)

Why this feels bigger than a garden‑variety employment dispute

- TSMC (Taiwan Semiconductor Manufacturing Company) isn’t just any supplier — it’s the world’s dominant advanced contract chipmaker, steward of production know‑how for the most cutting-edge process nodes. The executive at the center of the case played senior roles in scaling multiple advanced nodes, which is why TSMC framed the move as a major risk to trade secrets. (reuters.com)

- Taiwan’s prosecutors have flagged potential violations under not just trade‑secret laws but also the National Security Act, signaling this could be treated as more than a commercial case and touching state-level technology protections. (taipeitimes.com)

- Intel has publicly defended the hire and denied any evidence of wrongdoing while asserting it enforces strict policies to prevent misuse of third‑party IP. The firm also emphasized the return of seasoned talent as part of its engineering push. (reuters.com)

These elements turn a personnel dispute into a flashpoint where corporate law, national security, and the shifting geopolitics of supply chains intersect.

The context you need to know

- Talent moves are a normal — even healthy — part of technology ecosystems. Senior engineers and managers often switch firms, carrying experience and institutional knowledge. But when that knowledge concerns microfabrication techniques that took billions of dollars and decades to perfect, the stakes rise. (reuters.com)

- Taiwan treats certain semiconductor capabilities as strategic. Protecting advanced-node process knowledge is bound up with national economic and security interests; authorities have tools to investigate and seize assets when those boundaries are thought to be crossed. (taipeitimes.com)

- The global chip race is intensifying: the U.S. has moved to underwrite domestic foundry capacity, and Intel — under new leadership and with renewed government attention — is positioning itself to scale foundry operations at home. That broader backdrop makes any transfer of advanced manufacturing know‑how politically sensitive. (washingtonpost.com)

What this could mean geopolitically and for investors

- If authorities determine that trade secrets were transferred or that export of certain technologies violated Taiwanese rules, the case could result in injunctions, asset seizures, or stricter controls on how Taiwanese talent and know‑how are allowed to work abroad. That would ripple through global supply chains. (investing.com)

- There’s also an awkward overlay in the United States. In 2025 the U.S. federal government became a major financial backer of Intel through CHIPS‑related investments and — as reported in public coverage — acquired a significant equity stake. That makes any legal controversy involving Intel and Taiwanese technology suppliers more politically visible, and could complicate diplomatic and commercial channels if the dispute escalates. (cnbc.com)

- For investors, the short‑term impacts might show up as volatility in chip‑sector stocks and concerns about supply continuity. For customers and partners, the case raises questions about the permissible flow of people and IP across borders in a time of strategic decoupling.

What to watch next

- Court filings and prosecutorial statements in Taiwan for specifics on the allegations (what secrets are at issue, whether intent or actual transfer is alleged). (reuters.com)

- Official actions beyond evidence seizures: will Taiwan restrict certain talent movements or add licensing requirements for technologies considered “core” under the National Security Act? (taipeitimes.com)

- Intel’s and TSMC’s legal filings and public statements for how aggressively each side pursues remedies and defenses; and any U.S. government commentary given the country’s financial ties to Intel. (reuters.com)

A few practical implications

- For the semiconductor industry: expect heightened diligence in hiring senior process engineers who worked at advanced‑node fabs, and more emphasis on contractual protections and compliance checks.

- For governments: a reminder that industrial policy, national security, and human capital policy are converging — and that managing that intersection will require clearer frameworks around mobility and IP protection.

- For engineers and executives: the case underscores the need to document provenance of work, abide by contractual obligations, and get counsel when moving between firms with overlapping technical footprints.

My take

This episode is a warning the industry has been circling for years: in a world where leading-edge chipmaking is both commercially vital and geopolitically sensitive, the movement of people can’t be seen as merely HR. It’s also a test of institutions — courts, regulators, and corporate compliance regimes — to respond without chilling beneficial knowledge exchange. The right balance would protect legitimate trade secrets and national interests while preserving the healthy flow of talent that drives innovation.

Whether this particular matter becomes a landmark legal precedent or a quickly resolved corporate spat depends on the facts investigators unearth and the legal theories pursued. Either way, it’s another illustration of how microelectronics — measured in nanometers — now shapes macro policy.

Points to keep in mind

- At this stage the seizure of devices and the lawsuit are part of an investigation; criminal charges were not immediately filed when news broke. (investing.com)

- The broader story sits at the intersection of corporate IP law, national security frameworks in Taiwan, and the geopolitics of semiconductor industrial policy — especially given the U.S. government’s elevated financial role with Intel. (washingtonpost.com)

Sources

Related update: We recently published an article that expands on this topic: read the latest post.

Medicare just picked 15 big-name drugs for steep price cuts — here's what it means

The headline alone is a jaw-dropper: Medicare will pay less for 15 high-cost medicines — including household names like Ozempic, Wegovy and several cancer treatments — after the latest round of negotiations under the Inflation Reduction Act. That change, announced by the Centers for Medicare & Medicaid Services, is scheduled to take effect January 1, 2027, and CMS says the negotiated prices would have shaved billions off last year’s spending if they’d already been in place. (cms.gov)

Why this matters right now

- Drug prices are a top worry for older Americans and people with chronic illnesses; Medicare Part D covers many of the therapies on this list.

- The Medicare negotiation program — born out of the Inflation Reduction Act of 2022 — is moving from pilot to policy: this is the second batch of negotiated drugs, bringing the total with final prices to 25. (cms.gov)

- Some of the medicines targeted are among the fastest-growing sellers in the pharmaceutical market (notably GLP-1 drugs for diabetes and weight loss), so the political and commercial ripples will be big. (washingtonpost.com)

A quick snapshot of what's on the list

- GLP-1 drugs: Ozempic, Wegovy, Rybelsus (diabetes and weight-loss).

- Asthma/COPD inhalers: Trelegy Ellipta, Breo Ellipta.

- Cancer drugs: Xtandi, Pomalyst, Ibrance, Calquence.

- Other chronic-disease drugs: Janumet (diabetes), Tradjenta, Otezla (psoriatic arthritis), Linzess (IBS), Xifaxan, Austedo (movement disorders), Vraylar (psychiatric). (cms.gov)

What the price cuts actually look like

CMS reports negotiated discounts ranging widely — from substantial (dozens of percent off list price) to very large (some as high as about 70% for certain GLP-1 drugs in reporting). CMS estimates these second-round deals would have reduced Medicare spending by billions in a single year and projects material out-of-pocket relief for beneficiaries once the prices take effect. Exact monthly/annual costs for individual patients will still depend on their plan design and whether the manufacturer participates in the finalized deals. (cms.gov)

The stakes for patients, companies and taxpayers

- Patients: Lower Medicare-negotiated prices should reduce out-of-pocket costs for many seniors who use these drugs, especially those who reach catastrophic spending. CMS also pointed to a broader out-of-pocket cap in Part D that complements these negotiations. (cms.gov)

- Drugmakers: These negotiations can cut into revenues for blockbuster medicines, prompting pushback from industry — from public relations campaigns to lawsuits. Companies can choose to participate in negotiations (and accept a lower “maximum fair price”) or refuse and face penalties such as excise taxes or exclusion from Medicare markets. (cms.gov)

- Taxpayers/government: CMS frames the moves as meaningful federal savings; independent analysts and outlets have produced different estimates, but the consensus is these rounds will save Medicare and beneficiaries billions over time. (cms.gov)

The practical complications to watch

- Timing and transitions: Negotiated prices become effective January 1, 2027. Until then, current list/pricing structures remain in place, and insurers will have to adjust formularies and cost-sharing schedules ahead of implementation. (cms.gov)

- Manufacturer responses: History suggests some companies will litigate or otherwise resist; others may negotiate quietly. That can affect availability, manufacturer assistance programs, and how quickly savings reach patients. (apnews.com)

- Market effects: Large discounts on GLP-1s and other best-sellers could shift prescribing patterns, spur competition, and influence drug development priorities. How innovation incentives change is a central political and economic debate. (washingtonpost.com)

What to watch next

- Implementation details from CMS and Plan Sponsors: how Part D plans will show beneficiary savings (copays vs. coinsurance), and whether manufacturers alter patient support programs.

- Legal challenges from manufacturers and any court rulings that could delay or reshape the program.

- Market responses: price moves on competing therapies, potential shifts in formulary placement, and whether private insurers seek similar negotiated prices.

Quick takeaways for readers

- These negotiations are real, targeted, and scheduled to take effect Jan 1, 2027. (cms.gov)

- The second round covers 15 drugs used for diabetes, weight loss, cancer, asthma and other chronic conditions — many are widely used and high-spend items for Medicare. (cms.gov)

- Expected savings are large in aggregate but will vary for individual patients based on their plan and whether they hit the new out-of-pocket cap. (cms.gov)

My take

This moment is a practical test of a policy born from the Inflation Reduction Act: can government negotiation deliver meaningful relief without tangling the market in legal and logistical knots? The answer will be messy at first — implementation always is — but millions of Medicare beneficiaries stand to gain tangible relief if the rules play out as CMS projects. The bigger policy conversation — balancing affordability with incentives for pharmaceutical innovation — will continue to be fought in courtrooms, boardrooms and Congress. For now, patients facing high drug bills should follow their plan notices and work with providers and pharmacists to understand the impacts once 2027 approaches. (cms.gov)

Sources

Related update: We recently published an article that expands on this topic: read the latest post.

A tricky morning for the market: futures wobble while AI drama rattles Nvidia

Wall Street opened with a bit of that stomach-flip feeling investors know too well — futures flirting with a key level as big tech news rearranged the mood. Nvidia slipped after reports that Google (and possibly Meta) are moving more seriously into AI chips, while earnings from companies like Alibaba and Best Buy provided bright spots. The result: cautious optimism, punctuated by a reminder that narratives — and who controls AI compute — still move markets.

What to notice right away

- S&P 500 and Nasdaq futures were teetering around an important technical level, signaling that the major indexes face a decisive day (or week) ahead.

- Nvidia shares dropped after news that Google’s AI chips (TPUs) are being pitched more aggressively and that Meta may be in talks to use Google’s chips — a development that raises questions about market share in AI hardware.

- Retail and cloud-related earnings (Alibaba, Best Buy among them) surprised on the upside, giving pockets of the market fuel even as AI headlines dominated the tape.

Why futures matter this morning

- Futures act like a pre-market temperature check: small price differences can amplify when regular trading opens.

- When futures “waver at a key level,” traders interpret that as indecision at an important technical barrier — the line between a resumption of the uptrend or a pullback that could invite volatility.

- That indecision is particularly potent now because the market’s leadership is concentrated in a handful of mega-cap tech names; any uncertainty there can sway broad indexes.

The Nvidia story (short and relevant)

- The kerfuffle centers on reports that Google has been moving to offer its tensor processing units (TPUs) more broadly and that Meta may consider buying or renting them for data-center AI workloads.

- For Nvidia, whose GPUs dominate AI training and inference today, that’s a credible competitive threat if big customers diversify away or rent capacity elsewhere.

- Markets reacted: Nvidia down; Google/Alphabet gained ground as investors priced the prospect of a stronger cloud/chip offering. But analysts remain split between near-term price pressure and longer-term confidence in Nvidia’s ecosystem and product roadmap.

Earnings winners: Alibaba and Best Buy

- Alibaba: The company’s AI initiatives (including Qwen and other cloud efforts) and improving execution have investors rewarding the stock. Positive earnings or user/engagement data tends to revive confidence in its growth narrative beyond just Chinese e-commerce.

- Best Buy: A solid retailer report — especially during a season where tech and appliance demand matters — reminded markets that cyclical earnings can still surprise positively and support discretionary retail names even as tech headlines dominate.

The investor dilemma

- Focus vs. diversification: Are you trading the headlines (short-term swings tied to AI chip deals) or positioning for structural trends (AI spending continuing to balloon, where Nvidia still has advantages)?

- Technical risk vs. fundamental conviction: Futures waver at key levels often trigger stop runs and increased volatility. Long-term investors should ask whether a headline-driven drop meaningfully changes the underlying business case.

- Earnings pockets vs. market leadership: Retail winners and cloud/AIs successes can provide rotation opportunities, but broad indices are heavily weighted to the biggest tech names — which still drive the market’s direction.

Strategic thinking (practical ideas, not advice)

- If you’re short-term trading, watch the futures level closely: a clear break (with volume) could invite follow-through; a hold and reversal often signals buyers stepping in.

- For swing or longer-term investors, separate the signal from the noise: a one-off report about chip deals is newsworthy but doesn’t instantly rewrite competitive moats — track customer wins, product compatibility, and supply commitments over several quarters.

- Consider diversification across AI plays: chips (Nvidia), cloud/service providers (Google, AWS, Microsoft), and select application-layer companies that monetize AI rather than supply raw compute.

- Earnings surprises in areas like retail (Best Buy) and cloud/AI adoption (Alibaba) show rotation can matter — scanning relative strength and volume after reports helps find durable moves.

Market mood and what to watch next

- Watch how major indexes behave if/after they clear the “key level” in futures. A decisive breakout could renew the rally; a failure could bring renewed volatility and profit-taking.

- Keep an eye on follow-up reporting about the Google/Meta/TPU discussions and any official statements from Nvidia or Google — markets often move again when the details (or denials) arrive.

- Monitor next wave of earnings and guidance: retailers, cloud providers, and chip suppliers will shape whether headlines are transitory or signal a deeper reshuffling.

Quick takeaways

- Markets are at a crossroads: technical indecision in futures plus headline risk from AI supply competition equals heightened short-term volatility.

- Nvidia’s pullback reflects legitimate concerns about compute competition, but it doesn’t instantly erase Nvidia’s ecosystem advantages.

- Earnings from Alibaba and Best Buy show pockets of fundamental strength that can offer rotation opportunities amid headline-driven noise.

My take

This is a classic example of markets balancing two currents: headline-driven rotation (who supplies which chips) and the longer-running structural story of AI adoption. Short-term traders will be reactive — and rightly so — but long-term investors should weigh whether today’s headlines change durable revenue and margin pathways. For now, expect chop: the indexes are being tested, and the winners will be those who can blend quick risk management with a patient view on AI’s multi-year buildout.

Sources

Related update: We recently published an article that expands on this topic: read the latest post.

When a Rival’s Win Becomes Your Windfall

Bristol Myers Squibb (BMY) got a bump on Monday — not because of its own press release, but because Bayer released what analysts called a “surprisingly positive” update on its experimental blood thinner, asundexian. The result: investors breathed new life into the broader class of Factor XIa inhibitors and pushed Bristol Myers shares higher. It’s one of those market moments that shows how biotech is often a group sport — your competitor’s breakthrough can validate your pipeline overnight.

Why a Bayer trial moved Bristol Myers

- Bayer’s Phase III OCEANIC‑STROKE trial reported that asundexian (50 mg daily), given with standard antiplatelet therapy, significantly reduced recurrent ischemic stroke risk in patients after a non‑cardioembolic ischemic stroke or high‑risk transient ischemic attack — and crucially, without increasing major bleeding. (bayer.com)

- Factor XIa inhibitors (the drug class) aim to uncouple thrombosis from normal hemostasis — meaning they could prevent clotting events like stroke while lowering bleeding risk compared with existing anticoagulants. That mechanism is precisely what drug developers such as Bristol Myers (milvexian) and others are trying to prove. (bayer.com)

- Investors treat successful late‑stage results for one program as partial proof‑of‑concept for the whole class. Bayer’s win raised the perceived odds that similar molecules — including Bristol Myers’ milvexian — can succeed in at least some indications, which translated into a multi‑percent pop in BMY stock. (investors.com)

A quick look at the players and timeline

- Bayer: announced positive topline results from OCEANIC‑STROKE on November 23, 2025, and said detailed results will be presented at an upcoming scientific congress. The company plans to engage regulators about potential marketing applications. (bayer.com)

- Bristol Myers Squibb: developing milvexian, another oral Factor XIa inhibitor. Milvexian had an earlier setback when an acute coronary syndrome (ACS) trial was halted for likely futility, but analysts now see greater odds for success in secondary stroke prevention after Bayer’s news. Bristol Myers expects key readouts for atrial fibrillation and stroke indications in 2026 (stroke) and late 2026 (AF study topline timing noted by analysts). (investors.com)

- Regeneron and other firms: also saw small moves after Bayer’s announcement, reflecting industry‑wide implications for the FXIa inhibitor class. (investors.com)

Why investors care beyond a single trial result

- The unmet-need math is compelling: recurrent stroke risk remains high, and current oral anticoagulants (like Factor Xa inhibitors) come with bleeding tradeoffs that limit use in some patients. A therapy that meaningfully lowers ischemic stroke risk without increasing major bleeding could shift practice and command large market share. (bayer.com)

- Drug development in cardiovascular and stroke indications often translates into multibillion‑dollar peak sales if regulators and clinicians accept the benefit/risk profile — which is why analysts quickly remapped revenue forecasts after Bayer’s topline. (investors.com)

- But “class validation” isn’t a guarantee. Molecules differ in pharmacology, trial designs matter, and regulatory hurdles remain. A positive headline helps, but each candidate must prove itself on its own data.

What to watch next

- Full data release: details on event rates, absolute risk reduction, subgroup analyses, and bleeding definitions (ISTH major bleeding vs. other metrics) will determine how convincing the result really is. Bayer said full results will be presented at a scientific meeting. (bayer.com)

- Bristol Myers’ milvexian readouts: timing and endpoints for milvexian’s stroke and atrial fibrillation trials — and whether milvexian reproduces asundexian’s safety/efficacy balance. Analysts have already increased probability estimates for some milvexian indications; the market will watch for Bristol’s own numbers. (investors.com)

- Regulatory feedback: Bayer plans to engage health authorities about applications; regulators’ responses (and any requests for additional data) will shape the approval timeline and commercial prospects. (reuters.com)

Market and scientific nuance

- Proof‑of‑concept at large scale: OCEANIC‑STROKE reportedly enrolled over 12,000 patients — a sizable dataset that, if robust, gives the result weight beyond small, early trials. Large phase III success can be a genuine inflection point. (bayer.com)

- Not all indications are equal: Bayer’s win was in secondary stroke prevention; earlier failures (e.g., atrial fibrillation) remind us that efficacy can vary by disease context. Analysts noted Bayer’s prior AF setback and cautioned extrapolating to every indication. (reuters.com)

- Competitive landscape: multiple companies are racing to develop FXIa inhibitors. A first approval for the class would change competitive dynamics rapidly, but differentiation (oral dosing, safety, efficacy in key subgroups) will matter for long‑term market share.

A few bite‑sized takeaways

- Bayer’s OCEANIC‑STROKE topline appears to validate the therapeutic potential of FXIa inhibition for secondary stroke prevention. (bayer.com)

- That validation lifted investor sentiment for peers, including Bristol Myers, which benefits from a stronger belief in milvexian’s prospects despite prior setbacks. (investors.com)

- Full data, regulatory reviews, and individual trial differences still determine winners — a class win is helpful, but not decisive.

My take

This is what makes biotech markets both thrilling and maddening: a single credible late‑stage readout can switch narratives overnight. Bayer’s result is an important proof‑point for Factor XIa inhibition and opens the door for rivals — but each program still needs to clear its own clinical and regulatory hurdles. For long‑term investors or clinicians, the sensible posture is curiosity plus scrutiny: welcome the class validation, then ask for the full data and watch how each molecule performs in its own trials.

Sources

Related update: We recently published an article that expands on this topic: read the latest post.

Related update: We recently published an article that expands on this topic: read the latest post.

How a $20 fast‑food wage became a political punchline — and what the data actually shows

Who doesn’t love a good one‑liner? When former President Trump said California’s $20-per-hour fast‑food minimum wage was “hurting businesses,” the quote fit neatly into a familiar story: big wage hike → shuttered restaurants → unhappy voters. But real life, as usual, refuses to be tidy. The first year after California’s sectoral wage increase has produced a muddled mix of headlines, studies and anecdotes — and the truth sits somewhere in the middle.

What happened and why it mattered

- In September 2023 California passed AB 1228, creating a Fast Food Council and setting a $20 minimum wage for fast‑food workers at chains with 60+ locations nationwide, effective April 1, 2024. (gov.ca.gov)

- The policy targeted roughly half a million workers and was one of the largest sector‑specific wage hikes in recent U.S. history.

- Opponents warned of rapid price inflation, job losses, reduced hours and store closures. Supporters argued workers needed a living wage and that higher pay could reduce turnover and boost consumer demand.

Headlines vs. data: why simple answers don’t fit

Political rhetoric loves certainty, but economists use careful comparisons. Since April 2024 the evidence has been mixed:

-

Studies and analyses finding minimal negative effects:

- Research from UC Berkeley’s Institute for Research on Labor and Employment and related teams report that wages rose substantially, employment held steady, and menu price impacts were modest (single‑digit percent increases for typical items). These studies emphasize higher worker earnings without detectable job losses in the fast‑food sector. (irle.berkeley.edu)

- Other academic teams (Harvard Kennedy School / UCSF) reached similar conclusions about pay gains and limited staffing impacts. (gov.ca.gov)

-

Studies and analyses finding measurable job declines:

- Working papers using Bureau of Labor Statistics payroll data (Quarterly Census of Employment and Wages) — and critiques from policy groups like the Cato Institute — estimate a small but nontrivial reduction in fast‑food employment in California relative to other states, translating into thousands of jobs potentially lost or displaced. These analyses point to a 2–4% differential decline in sector employment in the year after the law passed. (nber.org)

-

Industry and media snapshots added color (and noise):

- Chains and franchisee groups announced price increases and operational changes; some local closures and staffing adjustments were reported in the press and by trade groups. At the same time, state officials pointed to jobs data showing growth in fast‑food employment in some months. Media outlets highlighted both anecdotes of closures and studies showing limited harm. (cnbc.com)

The upshot: different data sources, time frames, and methods yield different estimates. Short‑run payroll snapshots can show dips that later rebound; survey‑based and restaurant‑level pricing studies can miss informal shifts (delivery volume, operating hours, mix of part‑time vs full‑time). Context, timing and research design matter.

Four reasons the debate stayed messy

- The policy was sectoral and targeted. It applied only to large chains (60+ locations), leaving many small restaurants out of scope — which complicates comparisons and “one‑size” conclusions. (gov.ca.gov)

- Timing and price pass‑through. Chains can respond by raising prices, squeezing profits, automating, or changing franchise decisions. Price increases were modest on average per some studies, but consumer behavior and foot traffic patterns varied across markets. (irle.berkeley.edu)

- Geographic and local wage baselines differ. Many California cities already had higher local wages, so the bite of a statewide $20 floor varied by city and region. (cnbc.com)

- Data source differences. Administrative payroll counts, operator surveys, foot‑traffic trackers and economist regressions each capture different slices of reality. Survey respondents tend to report the most painful anecdotes; large administrative datasets smooth over firm‑level churn but can lag. (nber.org)

What the evidence implies for workers, employers and voters

- Workers: Many fast‑food employees saw meaningful pay bumps. For low‑paid workers, a reliable raise can improve household finances and reduce turnover — which itself can save restaurants hiring and training costs. Several academic teams documented substantial wage gains. (irle.berkeley.edu)

- Employers: Large national chains and well‑capitalized operators can typically absorb or pass through costs more easily than small franchisees and mom‑and‑pop operators. Some franchisees reported tightening margins or operational shifts. Franchise structure therefore matters for who feels the pain. (cnbc.com)

- Consumers: Menu prices rose in many places but, according to some detailed price studies, by relatively modest amounts for common items. Still, for price‑sensitive customers, even small increases can change visit frequency over time. (irle.berkeley.edu)

- Policy makers: The California experiment shows that sectoral wage rules are feasible and politically potent — but also that they require monitoring, local nuance and careful evaluation to spot unintended consequences.

What to watch next

- Updated employment and payroll reports for 2024–2025 (BLS QCEW, state employment dashboards).

- Fast‑food council adjustments: the law created a Fast Food Council that can change wage floors going forward — any upward tweaks will reignite debates. (gov.ca.gov)

- New peer‑reviewed studies that reconcile firm‑level evidence with state administrative data. The early literature includes conflicting working papers; later, more refined analyses will matter for policy learning. (nber.org)

Key points to remember

- Big, immediate headlines are tempting, but the empirical record is mixed — some rigorous studies find little harm to employment, others find modest job declines.

- The distribution of effects matters: workers gained wages, while some operators (especially small franchisees) faced higher costs and operational strain.

- Policy design (who is covered, how enforcement works, and whether wages are phased or sudden) shapes outcomes as much as headline wage numbers do.

My take

Policies that push wages up for low‑paid workers deserve scrutiny, not sloganeering. California’s $20 experiment shows that meaningful wage increases can lift paychecks without catastrophic collapse — but they are not costless. The right takeaway is pragmatic: expect tradeoffs, design for local differences, measure outcomes rigorously, and be ready to adjust. Political one‑liners make for headlines; careful evidence makes for better policy.

Sources

Related update: We recently published an article that expands on this topic: read the latest post.

Related update: We recently published an article that expands on this topic: read the latest post.

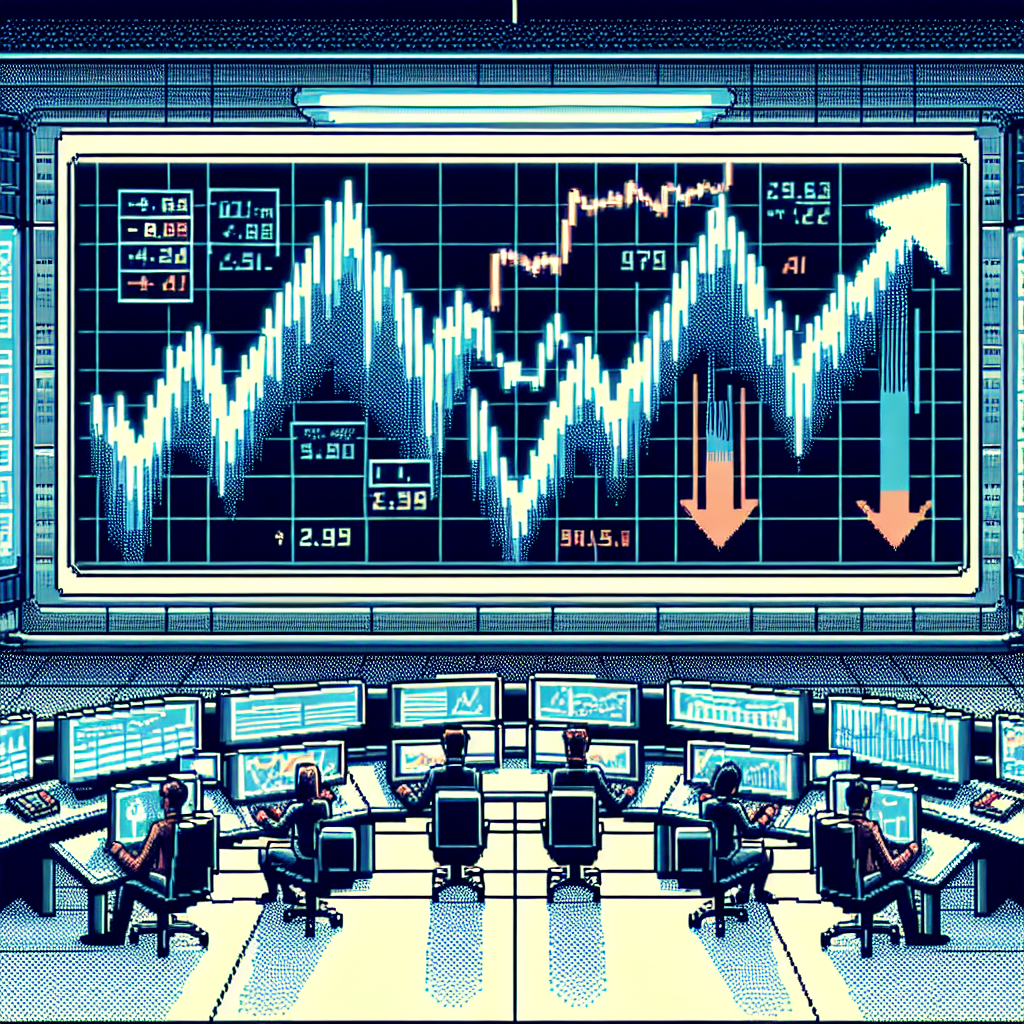

Stocks Rally as Rate-cut Odds Soar: Why a Single Fed Voice Moved Markets

Markets can be moody, and on November 21, 2025 they were downright fickle. One speech from a senior Fed official — New York Fed President John Williams — was enough to flip investor sentiment, send stocks higher and reprice the odds of a rate cut at the Fed’s December meeting. But the story isn’t just about a single quote; it’s about how fragile market expectations have become and why investors now have to navigate a Fed that sounds increasingly divided.

An attention-grabbing moment

- In prepared remarks delivered at a Central Bank of Chile event on November 21, 2025, John Williams said he “still see[s] room for a further adjustment in the near term” to move policy closer to neutral.

- Markets reacted fast: major indexes rallied intraday (the Dow, S&P 500 and Nasdaq all jumped), bond yields fell and CME Group’s FedWatch tool sharply increased the probability priced in for a 25-basis-point cut at the December 9–10 Fed meeting. (forbes.com)

That single dovish tilt — from a Fed official who sits permanently on the Federal Open Market Committee — was enough to reverse a recent shift toward pausing further easing. But Williams’ view wasn’t unanimous inside the Fed: other officials publicly backed holding rates steady for now, keeping uncertainty high. (forbes.com)

Why Wall Street cared so much

- Expectations rule short-term flows. Futures and options markets move quickly when a credible policymaker signals a change. Williams is influential; his willingness to countenance another cut pushed traders to reprice December odds aggressively. (forbes.com)

- Rate-sensitive sectors react fast. Homebuilders, gold, and consumer discretionary names — equities that benefit when borrowing costs fall — saw notable gains as investors positioned for easier policy. Technology and cyclical names that had previously weathered a hawkish Fed also saw rotations. (investopedia.com)

- Bond markets set the backdrop. Treasury yields fell on the news, reflecting both the revised odds of policy easing and a quick move toward safer, lower-yield pricing. That in turn supports equity valuations by lowering discount rates for future earnings. (mpamag.com)

The Fed’s internal tension

- Williams emphasized the labor market softness and said upside inflation risks had “lessened somewhat,” arguing there’s room to nudge policy toward neutral. But other officials and many market analysts remained cautious, pointing to still-elevated inflation readings and patchy labor data as reasons to hold steady. (forbes.com)

- The result is a split Fed narrative: a powerful, market-moving voice saying “near-term cut possible,” and several colleagues advocating patience. That split creates whipsaw risk — big moves when each new datapoint or comment arrives.

What investors should watch next

- The December 9–10 FOMC meeting calendar date. Markets have reweighted odds, but a true signal will come from Fed communications and incoming data between now and the meeting. (investopedia.com)

- Labor-market indicators. Williams flagged downside risks to employment; if payrolls and wage growth weaken, the Fed’s tolerance for cuts grows. Conversely, stronger-than-expected job prints or stubborn inflation would swing the pendulum back. (forbes.com)

- Fed rhetoric cohesion. Look for whether other Fed officials echo Williams’ tone or double-down on restraint. If the Fed’s public messaging becomes more uniform, the market’s volatility should ease. If the split persists, expect continued intra-day reversals. (finance.yahoo.com)

What this means practically:

- Portfolio positioning may tilt toward rate-sensitive sectors if cuts look probable, but the risk of being wrong is real — a single stronger data release could flush those positions.

- Volatility will remain elevated while the Fed’s internal debate plays out and the economic data stream remains mixed.

Quick takeaway points

- A single influential Fed official can materially shift market expectations; John Williams’ “near-term” comment on Nov 21, 2025 did exactly that. (forbes.com)

- Markets now price a much higher chance of a December rate cut, but the Fed is not united — several officials have favored maintaining current rates. (reuters.com)

- Incoming labor and inflation data, plus the Fed’s subsequent communications, will determine whether this rally has legs or is a short-lived repricing.

My take

This episode is a reminder that markets trade not only on data but on narratives. A narrative shift — in this case, that the Fed might ease sooner — can drive swift, meaningful reallocation across assets. For investors, the sensible middle path is to respect the potential for policy easing while protecting against the opposite outcome. In practice, that means balancing exposure to assets that benefit from looser policy with hedges or sizing discipline in case the Fed leans back into restraint.

Sources

(Note: the Forbes story that prompted this piece ran on November 21, 2025; Reuters and Investopedia provide non-paywalled coverage and context cited above.)

Related update: We recently published an article that expands on this topic: read the latest post.

Related update: We recently published an article that expands on this topic: read the latest post.

A surprising flip: college grads are 25% of the unemployed — what that really means

You’ve probably heard the headline: Americans with four‑year degrees now make up a record 25% of the unemployed. It sounds like a sudden education crisis — but the story is subtler, and more revealing about how the U.S. labor market is changing.

This post unpacks why that 25% number matters, what’s driving it, and what it means for workers, employers, and anyone trying to read the economy’s next moves.

Why the headline feels wrong (and why it’s not)

- A rising share of unemployed workers holding bachelor’s degrees does not automatically mean college is devalued.

- Two broad forces are at work at the same time:

- The share of U.S. workers with bachelor’s degrees has been steadily increasing for decades — more degree‑holders in the labor force means degree‑holders also make up a larger slice of any labor statistic, even unemployment.

- White‑collar hiring has cooled sharply during recent hiring cycles, and layoffs in certain industries (notably tech and other professional sectors) have put more degree‑holders into unemployment than in prior years.

In short: more college‑educated people are in the workforce than before, and many of the jobs that typically employ them have slowed hiring or cut back.

The bigger context you should know

- Educational attainment has risen across generations. The Pew Research Center notes that the share of workers with at least a bachelor’s degree climbed substantially over the last two decades. As degrees become more common, statistics that show the distribution of unemployment naturally shift. (pewresearch.org)

- At the same time, macro shifts have curtailed hiring in white‑collar roles. Firms in technology, finance, and professional services trimmed headcount in recent years, and many employers have become more cautious about new hires — a trend highlighted across reporting on 2024–2025 labor developments. This increases the visibility of unemployed degree‑holders in headline snapshots. (reuters.com)

- The Bureau of Labor Statistics still shows that, on average, higher education correlates with lower unemployment rates and higher earnings — the “education pays” pattern remains intact when you look at unemployment rates by attainment, not just shares of the unemployed. That nuance matters: degree‑holders still tend to have lower unemployment rates than less‑educated peers. (bls.gov)

What the 25% figure actually signals

- It signals a slowdown in the kinds of hiring that have absorbed college grads in prior cycles — recruiting freezes, slower openings in corporate roles, and sectoral layoffs. Those trends push degree‑holders into unemployment faster than replacements arrive.

- It also signals composition change: as more people obtain four‑year degrees, they become a larger slice of both the employed and unemployed populations. A record share of unemployed degree‑holders can therefore reflect both real job losses in certain sectors and a long‑term shift in worker education levels.

- It is not, by itself, proof that a bachelor’s degree no longer opens doors. The BLS data continue to show lower unemployment rates and higher median earnings for those with bachelor’s and advanced degrees compared with less‑educated workers. (bls.gov)

Who’s most affected

- Workers in mid‑career white‑collar roles tied to corporate spending, advertising, or enterprise tech have felt the most abrupt swings. Tech layoffs beginning in 2022–2023 and periodic waves of cuts among professional services have a disproportionate effect on degree‑holding unemployment.

- New graduates may face softer entry markets when employers pull back on hiring, while mid‑career professionals can be hit by structural shifts (outsourcing, AI tools changing role scopes, demand slowdowns).

- Geographical and industry differences remain large: local markets and certain occupations still have strong demand for degree‑level skills.

What workers and employers can do now

- For workers:

- Build adaptable skills that translate across roles (data literacy, project management, communication).

- Consider expanding the toolkit beyond a single specialization — short courses, certificates, and targeted reskilling can help in tighter markets.

- Network intentionally and consider lateral roles that keep you employed while you pivot.

- For employers:

- Reassess talent pipelines: if hiring is slow, invest in retention, internal mobility, and upskilling rather than broad layoffs that can hollow out future capacity.

- Be explicit about which skills are truly mission‑critical; avoid relying on degree as a blunt proxy for ability.

A few caveats for reading labor headlines

- Watch denominators: percent shares are sensitive to who’s in the labor force. More degree‑holders overall naturally raises their share of unemployment unless hiring rises proportionally.

- Check both unemployment rates (chance of being unemployed within a group) and shares of the unemployed (composition across groups). They tell different stories.

- Sector and age breakdowns matter. National aggregate headlines can mask very different trends across industries and regions.

Key takeaways

- The 25% headline is real, but it’s a composite effect: more degree‑holders in the workforce plus weaker white‑collar hiring.

- Education still correlates with lower unemployment rates and higher earnings — the value of a degree hasn’t been overturned by this statistic alone. (bls.gov)

- The labor market is shifting: employers and workers both need to focus more on adaptable, demonstrable skills than on credentials alone.

- Read both rates and shares, and look beneath national headlines to industries, age groups, and local markets for the clearest signal.

My take

This is a useful corrective to a simple narrative that “college equals job security forever.” The modern labor market rewards adaptability as much as credentials. For policy and corporate leaders, the right response isn’t to declare degrees obsolete, but to invest in continuous training, clearer signals of skill, and pathways that let degree‑holders reskill into growing roles. For individuals, the smartest hedge is to pair credentials with a mindset and portfolio of skills that travel across jobs and sectors.

Sources

Related update: We recently published an article that expands on this topic: read the latest post.

Nvidia at the Crossroads: Big Expectations, Bigger Questions

The buzz was electric heading into Nvidia’s fiscal third-quarter earnings on November 19, 2025. After years of setting the bar for AI-driven growth, NVDA arrived at the report with sky-high expectations — and a chorus of voices telling investors to either hold fast for the long haul or tighten the seatbelt for a fast ride down if things go wrong.

This post digests a recent TipRanks piece featuring top investor Adria Cimino, places that view against the broader market backdrop, and offers a grounded take on what mattered (and what still matters) after the results landed.

Why this quarter felt different

- Nvidia’s leadership in AI datacenter GPUs — particularly the Blackwell family — had been fueling extraordinary demand across cloud providers and enterprise AI deployments. Analysts and market narratives had tilted heavily bullish going into the print. (tipranks.com)

- At the same time, high-profile skeptics and macro concerns introduced volatility risk: a few big shorts and notable institutional moves (for example, some stake sales) added a frisson of near-term unpredictability. That’s one reason commentators cautioned about big swings around the release. (tipranks.com)

- TipRanks highlighted a common investor dilemma: impressive fundamentals and growth potential versus frothy multiples and the risk of sentiment-driven pullbacks. Adria Cimino framed it as a long-term buy thesis tempered by a recommendation to manage position sizing if you’re nervous. (tipranks.com)

What the market and the headlines were expecting

- Street consensus headed into the report expected another blowout quarter driven by datacenter revenue and continued strength in AI capex; pre-report estimates centered on revenue in the mid-$50 billions and elevated margins. (nasdaq.com)

- Analysts broadly favored Nvidia: the consensus on TipRanks showed heavy Buy support and an average 12‑month target implying material upside from then-current prices. But that bullishness coexisted with warnings about valuation and concentration risk. (tipranks.com)

The real outcome (brief recap with context)

Nvidia reported fiscal Q3 results on November 19, 2025 that materially beat expectations: revenue and EPS were well above consensus, driven by an outsized datacenter performance and sustained demand for the Blackwell GPUs. The company also issued bullish guidance for the following quarter. Market reaction was positive, with shares moving higher after the print. (kiplinger.com)

How to read Cimino’s view now

- The TipRanks piece distilled a pragmatic long-term endorsement: Cimino views Nvidia’s multiple as justifiable given the company’s earnings power and secular position in AI infrastructure, but she also urged that investors consider locking in gains or trimming exposure if they’re uncomfortable with near-term volatility. (tipranks.com)

- That advice maps well to a risk-management playbook: for long-term believers, dollar-cost averaging or holding but trimming size can reduce regret if sentiment shifts; for traders, earnings-driven swings create opportunities — and risks — for quick profits or losses.

Three practical investor angles

- For long-term holders:

- Nvidia’s structural leadership in AI hardware makes a compelling case to stay invested, particularly if you’re multi-year focused and can stomach large interim drawdowns. The company’s margin profile and datacenter growth were strong evidence for that thesis. (proactiveinvestors.com)

- For swing traders:

- Earnings and guidance often generate high intraday volatility. Having a pre-defined plan (entry, stop-loss, position size) is crucial. The presence of big shorts and institutional stake moves can amplify moves. (barrons.com)

- For cautious or value-oriented investors:

- Consider taking partial profits after a long run-up or using hedges (like options strategies) to protect gains while retaining upside exposure. Pay attention to guidance consistency and signs of demand broadening beyond hyperscalers.

Signals to watch next

- Datacenter demand durability beyond hyperscalers — broad adoption across industries reduces concentration risk.

- Gross margin trajectory and supply-chain signals; Nvidia’s margins historically exceeded many peers, but sustaining that while scaling is key. (tipranks.com)

- Management guidance and commentary about customer mix, international demand, and inventory dynamics.

- Macro and sentiment shifts: headline shorts, large stake sales, or regulatory news can create outsized price moves detached from fundamentals. (barrons.com)

What this means for the average investor

- The take from TipRanks — and echoed by many analysts — is straightforward: Nvidia’s business fundamentals justify a bullish long-term stance, but the stock’s multiple and the market’s sentiment make it a bumpy ride. If you believe in Nvidia’s multi-year role powering AI infrastructure, align your allocation and expectations to that horizon. If you’re near-term focused, prepare for volatility or consider reducing concentrated exposure. (tipranks.com)

My take

Nvidia’s Q3 showed why it’s central to the AI hardware story: the results validated the demand thesis. But market leadership comes with higher scrutiny and a premium multiple — and that premium is sensitive to sentiment swings. For investors, the most productive move is usually not to chase headlines but to match allocation to conviction and to protect against the inevitable short-term noise. Treat NVDA like a powerful engine: tremendous upside with a throttle that occasionally sticks.

Sources

Related update: We recently published an article that expands on this topic: read the latest post.

Related update: We recently published an article that expands on this topic: read the latest post.

Nvidia lost its throne — for now. Can it get it back?

Everyone loves a story with a king, a challenger and a battlefield you can see from space. In 2023–2024, Nvidia played the role of that king in markets: GPUs, AI training, data-center megadeals, and a market-cap narrative few could touch. But by the time earnings rolled around this year, the tone was different. Nvidia still powers much of today's generative-AI engine, yet investor attention has tilted toward other names — Broadcom, AMD and software-heavy infrastructure plays — leaving Nvidia “no longer the most popular AI trade,” as headlines put it.

This piece sketches why that cooling happened, what Nvidia still has working in its favor, and what it would take to reclaim the crown.

What changed — the short version

- Valuation fatigue: Nvidia’s meteoric run priced near-perfection into the stock. When guidance or growth showed any sign of slowing, traders rotated.

- Competition and alternatives: AMD’s data-center push and Broadcom’s optics and networking play offer investors different ways to access AI growth without Nvidia’s valuation premium.

- Geopolitics and China exposure: U.S. export controls constrained parts of Nvidia’s China business, introducing a real — and visible — revenue loss.

- Sector rotation: Investors hunting “safer” or differentiated AI exposures leaned into companies with recurring software or networking revenues rather than pure GPU plays.

Why this matters now (context and background)

- Nvidia’s GPUs are still the backbone of most large-scale training and inference installations, and the company’s ecosystems (CUDA, software stacks, partnerships) are deep and sticky.

- But markets aren’t just about fundamentals; they’re about narratives and expectations. Nvidia’s story became "priced for perfection," so anything less than blowout guidance could send the stock elsewhere.

- Meanwhile, rivals aren’t just knockoffs. AMD’s MI-series accelerators and Broadcom’s move into AI networking, accelerators and integrated solutions give cloud builders and enterprises credible alternatives — and different margin/growth profiles that some investors prefer.

Signals that Nvidia can still fight back

- Enduring technical lead: For many high-end training tasks and advanced models, Nvidia GPUs remain best-in-class. That technical moat is hard to erode overnight.

- Software and ecosystem lock-in: CUDA, cuDNN and Nvidia’s software stack create switching friction that favours long-term share retention.

- Strong demand backdrop: Large cloud providers and hyperscalers continue to expand AI capacity; when demand is this structural, winners keep winning.

- Product cadence: Nvidia’s roadmap (new architectures and system products) can reset expectations if they deliver step-change performance or cost advantages.

What Nvidia needs to do to reclaim investor excitement

- Deliver consistent, credible guidance: Beats matter, but so does proof that growth is sustainable beyond a quarter.

- Reduce geopolitical uncertainty: Either by restoring China access (if policy allows) or by clearly articulating alternative growth paths that offset China headwinds.

- Show margin resiliency and diversification: Investors will be more comfortable if Nvidia demonstrates it can grow without relying solely on hyper-growth multiples tied to a single product category.

- Highlight software/revenues or recurring services: Anything that lowers the volatility of revenue expectations helps the valuation story.

The investor dilemma

- Are you buying the market-share leader (Nvidia) at a premium and trusting the moat, or picking up cheaper, differentiated exposures (Broadcom, AMD, others) that might capture the next leg of AI spend?

- Long-term believers value Nvidia’s platform and ecosystem advantages. Traders looking for near-term performance or lower multiples have legitimate reasons to favor alternatives.

A few takeaway scenarios

- If Nvidia continues to post strong, unambiguous growth and guides confidently, institutional flows could reconcentrate and sentiment would likely flip back in its favor.

- If rivals close the performance or ecosystem gap while Nvidia’s growth or guidance softens, the market could keep reallocating capital away from a single-name concentration risk.

- Geopolitics — especially U.S.–China tech policy — is a wildcard. A policy easing that restores a sizable portion of China demand would be materially positive; further restrictions could accelerate diversification away from Nvidia.

My take

Nvidia didn’t lose because its tech failed — it lost some of the market’s patience. High expectations breed higher sensitivity to any hint of deceleration, and investors naturally explore alternatives that seem to offer similar upside with different risk profiles. That said, Nvidia’s combination of chips, software and customer relationships is still a heavyweight advantage. Reclaiming the crown isn’t impossible; it requires predictable execution, transparent guidance and progress on the geopolitical front. Long-term investors who believe AI is a multi-decade structural shift still have a clear reason to watch Nvidia closely — but the era of unquestioned dominance is over. The next chapter will be about execution, diversification and whether the market’s narrative can rewrite itself.

Useful signals to watch next

- Quarterly revenue and data-center trends versus guidance.

- Market-share updates in GPUs and any measurable gain by competitors.

- Announcements tying Nvidia hardware to recurring software or cloud offerings.

- Changes in U.S. export policy or meaningful alternative China channels.

- Large hyperscaler capex patterns and disclosed vendor choices.

Where I leaned for this view

- Coverage of Nvidia’s recent earnings and the market reaction — showing why the “priced-for-perfection” narrative matters.

- Reporting on export constraints and the macro/geopolitical context that undercut some growth expectations.

- Analysis of the competitive landscape (AMD, Broadcom and cloud providers) and how investors rotate among different ways to access AI upside.

Sources

Related update: We recently published an article that expands on this topic: read the latest post.

The squeeze on Main Street: why mom-and-pop shops are hunkering down

There’s a quiet panic in small-business towns across the country. Shop owners are trimming hours, delaying hires, and staring at spreadsheet scenarios that all end the same way — build cash, avoid risk, survive the next shock. The affordability crisis isn’t just about rising grocery bills; it’s a compound threat hitting mom-and-pop shops from every direction: higher import costs, rising payroll and health‑care bills, scarce affordable credit, and employees who are one rent check away from distraction. This is what happens when the cost-of-living crisis collides with a fragile small-business ecosystem.

Why this feels different right now

- Import and input costs have jumped for many small manufacturers and retailers, driven by tariffs and higher shipping costs that squeeze margins. Owners who used to pass only a fraction of price increases onto customers are now forced to choose between less profit and fewer sales. (finance.yahoo.com)

- Lending is available in some forms, but often expensive. Small-term business loans show average rates that are higher than they have been in recent memory, pricing out growth and forcing owners to hoard cash rather than invest. (finance.yahoo.com)

- Payroll and healthcare remain stickier costs. With wages and benefits rising, labor-intensive small businesses—cafés, shops, local manufacturers—face a double bind: pay more to retain staff or risk turnover and service disruption. (finance.yahoo.com)

- The workforce itself is stressed. When employees are worried about housing, groceries, or medical bills they bring that anxiety to work; productivity and customer service suffer. Business owners report distracted staff and a loss of morale that is hard to quantify but easy to feel at the register. (finance.yahoo.com)

Signals from the data and policy landscape

- Banks reported a modest uptick in demand for business loans in late 2024, but lending standards have tightened, and smaller borrowers often see higher effective rates or find themselves steered away from underwriting entirely. That mismatch leaves many Main Street businesses underserved. (reuters.com)

- The Small Business Administration (SBA) has increased small-dollar backing in recent years, which has helped some entrepreneurs access capital. But access remains uneven, and policy shifts or agency reorganizations can change the terrain quickly for small lenders and borrowers. (apnews.com)

What owners are doing (and why it matters)

- Hunkering down: owners are building cash reserves, delaying capital expenditures, and cutting discretionary spending. That preserves survival but stalls growth and job creation. (finance.yahoo.com)

- Shrinking payrolls: some have reduced staff or hours to manage labor costs. That reduces overhead but can also reduce revenue and community vibrancy. (finance.yahoo.com)

- Seeking alternate revenue: pop-up events, online channels, and partnerships can help, but not every business can pivot easily—especially manufacturers and service providers tied to local demand. (finance.yahoo.com)

- Shopping for credit carefully: owners are comparing SBA-backed options, community lenders, and commercial banks, but smaller, mission-driven loans are still scarce in some regions. (sba.gov)

A few human stories that put numbers in perspective

Across different reports, small-business owners say the same thing: uncertainty makes planning impossible. A Massachusetts manufacturer that recently laid off staff described an environment where tariffs and shifting trade policy dent demand overnight, forcing quick cuts and a focus on cash preservation rather than investment. Those individual decisions ripple through local economies—less payroll, fewer local purchases, and a community that slowly tightens its belt. (finance.yahoo.com)

What would help Main Street (practical levers)

- Expand small-dollar lending and streamline access. More predictable, affordable credit for loans under six figures helps owners bridge seasonal gaps and invest in productivity. SBA programs and community lenders can play a role but need scale and stability. (apnews.com)

- Targeted relief for input-cost shocks. Temporary tax credits, tariff adjustments, or subsidized logistics support could blunt abrupt cost spikes for small manufacturers who lack hedging tools used by larger firms. (finance.yahoo.com)

- Workforce support that stabilizes employees’ lives. Expanding access to childcare, emergency savings, and affordable health-care options reduces the non‑work distractions that hit productivity and retention. (finance.yahoo.com)

- Predictable policy environment. Businesses need fewer policy surprises—clearer trade and regulatory signals allow owners to plan hiring and capital expenditures with confidence. (finance.yahoo.com)

A short set of takeaways for readers

- Main Street is resilient but not invincible: small businesses are conserving cash and deferring growth while facing multiple cost pressures. (finance.yahoo.com)

- Credit exists but is uneven: SBA efforts have expanded small-dollar lending, yet many owners still pay high effective rates or face tighter underwriting. (apnews.com)

- The workforce crisis is an affordability crisis: stressed employees reduce productivity, and that compounds business stress. (finance.yahoo.com)

My take

This moment feels like a stress test for the local economy. Policies and markets have nudged mom-and-pop shops into a defensive crouch—and defense is a valid short-term strategy. But if we leave Main Street in that posture too long, we risk losing the entrepreneurial engine that drives jobs and community identity. The right mix of predictable policy, targeted support for credit and inputs, and investments that stabilize workers’ lives could flip a lot of these businesses back from “survive” to “grow.”

Sources

Related update: We recently published an article that expands on this topic: read the latest post.

Related update: We recently published an article that expands on this topic: read the latest post.

When Google Stumbles: What Happened When Drive, Docs and Sheets Glitched

A mid-day scramble. Students frantic over unsaved essays. Teams stuck at a meeting because a shared slide wouldn’t load. On Wednesday, November 12, 2025, thousands of users around the world discovered what many of us have been trained not to think about: what happens when the cloud hiccups.

This wasn’t a mysterious one-off. Reports spiked on outage trackers, Google acknowledged an incident on its Workspace status dashboard, and social feeds filled with the familiar mix of annoyance and resigned humor. Here’s a quick, readable walk-through of what happened, why it matters, and what you can do when the tools you rely on take an unscheduled break.

Quick summary

- The incident began around 09:00 PDT (17:00 UTC) on November 12, 2025 and affected Google Drive, Docs, Sheets (and related Workspace apps).

- Thousands of user reports—peaking in the low thousands on platforms like Downdetector—described connection failures, SSL errors (ERR_SSL_PROTOCOL_ERROR), and difficulty accessing files.

- Google posted updates on the Workspace Status Dashboard saying engineers were investigating and later reported mitigation and restoration steps.

- By late afternoon/evening the bulk of reports had fallen as services came back, but the outage lasted several hours for many users.

Why this felt so disruptive

- Google Workspace is deeply embedded in how people work and study: documents, slide decks, spreadsheets and collaboration are frequently accessed in real time. A partial or full outage pauses workflows.

- The error many users saw—SSL/secure-connection failures—reads like a network problem even when the root cause is on the service side, which makes troubleshooting confusing for non-technical users.

- Even short outages can cascade: scheduled meetings stall, automated workflows fail, and those “I’ll just grab it from Drive” moments turn into tense attempts to recover local copies.

A concise timeline

- Nov 12, 2025 ~09:00 PDT: Users begin reporting access issues for Google Drive, Docs and Sheets.

- Early afternoon: Downdetector and other services register a spike—several thousand reports at the peak.

- Google posts an incident on the Google Workspace Status Dashboard: “We are investigating access issues…” and notes symptoms including SSL errors.

- Over the afternoon: Google updates the dashboard as engineers identify and mitigate the problem; user reports decline as services are restored.

(Sources below include Google’s official incident page and independent outage trackers.)

What users reported and how Google responded

- User reports described inability to open files, “Error making file offline,” and secure-connection messages in browsers and mobile apps.

- Downdetector-style trackers captured the volume and geography of complaints in near real time, which amplified the sense of a broad outage.

- Google’s Workspace Status Dashboard confirmed the issue, described the symptoms, and provided ongoing status updates while its engineers worked on mitigation. At one point Google suggested routine troubleshooting (like rebooting routers or trying mobile access) as possible temporary workarounds for some users.

Practical tips for when cloud services fail

- Don’t panic — look for official signals:

- Check Google Workspace’s Status Dashboard for verified updates.

- Consult outage aggregators (Downdetector, StatusGator) to see if others are affected.

- Workarounds while services are down:

- Use local copies: if you have Drive for Desktop, check whether local sync copies exist.

- Try mobile vs. desktop; sometimes authentication or routing differences let one platform work while another doesn’t.

- If you’re on a team: switch to phone or another messaging platform to coordinate while Docs/Slides are unavailable.

- Longer-term resilience:

- Keep important files mirrored offline (periodic exports, local backups).

- For critical workflows, consider multi-cloud or multi-format backups (e.g., export important Google Docs to .docx or PDF periodically).

- Educate teams on outage protocols—who to contact, where to find status updates, and temporary communication plans.

What this outage says about cloud dependence

We love the instant collaboration cloud services enable. But every incident like this is a reminder that “always available” is a design goal, not a guarantee. Large providers generally have strong redundancy and rapid incident response, yet software, configuration or certificate issues can still ripple across millions of users.

The good news: major providers are transparent about incidents, and community signals (social media, Downdetector) help surface problems quickly. The practical lesson is not to distrust the cloud, but to plan for its rare failures—so one outage doesn’t become a full-blown crisis for your work or class.

My take

Outages are uncomfortable but useful wake-up calls. They refocus attention on simple, often neglected practices: keep local copies of mission-critical work, agree on fallback communication channels, and treat status dashboards as a standard bookmark for admin teams. The cloud makes life easier most of the time—when it trips, a little preparedness keeps you moving.

Sources

Related update: We recently published an article that expands on this topic: read the latest post.

Related update: We recently published an article that expands on this topic: read the latest post.

Related update: We recently published an article that expands on this topic: read the latest post.

Related update: We recently published an article that expands on this topic: read the latest post.

Hook: Is Q‑Day knocking or just tinkering in the lab?

IBM just rolled out a pair of quantum processors and a string of software and fabrication updates — and headlines from crypto blogs to tech outlets are asking the same jittery question: does this bring “Q‑Day” (the moment a quantum computer can break widely used public‑key encryption) any closer? The short answer: it’s meaningful progress, but not an immediate threat to Bitcoin or the internet’s crypto foundations. Still, the clock is ticking and the map to fault‑tolerant quantum machines is getting more detailed.

What IBM announced and why people care

- IBM introduced the Nighthawk processor (about 120 qubits, lots of tunable couplers) and showcased experimental “Loon” hardware that demonstrates key components for fault tolerance. (decrypt.co)

- They also reported software and decoder improvements (notably faster error‑decoding using qLDPC codes), moved more production into a 300 mm wafer line, and expanded Qiskit features to work more tightly with classical systems. Those software + fabrication changes speed development across the whole stack, not just raw qubit counts. (decrypt.co)

- IBM frames this as part of its “Starling” roadmap toward a fault‑tolerant quantum computer by around 2029, and a community‑verified “quantum advantage” milestone potentially as soon as 2026. (decrypt.co)

Why this isn’t Bitcoin’s immediate Apocalypse

- Cracking Bitcoin’s ECDSA signatures with Shor’s algorithm requires a fault‑tolerant quantum machine with roughly 2,000 logical qubits — which translates to millions (yes, millions) of physical qubits after error correction is accounted for. The Nighthawk and Loon systems are orders of magnitude short of that. (decrypt.co)

- Progress is incremental and expensive: improvements in decoder speed, couplers, fabrication, and software are crucial, but they don’t instantly collapse the massive engineering gaps that remain. Think many small bridges built toward a very distant island rather than a single teleport. (reuters.com)

How IBM’s advances change the timeline and the risk calculus

- The realistic risk picture has shifted from “if” to “when.” IBM’s roadmap and the engineering steps they’ve published make a plausible path to fault tolerance clearer than before, which is why observers move from abstract worry to specific timelines (late 2020s to early 2030s for large‑scale fault‑tolerant machines). (decrypt.co)

- Crucial enabling work — like real‑time decoders that run on classical hardware (FPGA/ASIC), modular architectures, and higher‑yield fabrication — reduces barriers but introduces new engineering challenges (e.g., system integration, error budgets across modules). Each solved piece reduces uncertainty, but none individually produce a Shor‑capable machine. (reuters.com)

What this means for different audiences

- For Bitcoin holders and crypto custodians: this isn’t a reason to panic‑sell, but it’s time to plan. “Harvest now, decrypt later” attacks (collecting encrypted traffic now to decrypt once quantum capability exists) remain a realistic long‑term concern. Start inventorying where private keys and sensitive encrypted archives live and consider migration or post‑quantum protections when feasible. (wired.com)

- For enterprises and governments: accelerate post‑quantum cryptography (PQC) adoption plans, prioritize high‑value assets, and test PQC implementations. The NIST post‑quantum standards and migration playbooks are now a strategic priority, not only academic exercise. (wired.com)

- For researchers and developers: IBM’s open tooling (Qiskit updates, shared benchmarks) and their community‑verified trackers present real opportunities to validate claims and build the software stack that will matter on fault‑tolerant machines. Collaboration will shape the outcome. (decrypt.co)

A few nuances investors and observers often miss

- Qubit count ≠ immediate capability. Connectivity, gate fidelity, error rates, and—critically—logical qubit construction via error correction are the real measures of practical quantum impact. Companies often lead with qubit numbers because they’re simple headlines. (spectrum.ieee.org)

- Roadmaps and targets (like 2026 quantum‑advantage or 2029 fault tolerance) are useful planning devices, not guarantees. The history of complex engineering programs is full of slips, iterations, and unexpected pivots. But IBM’s shift to larger wafer fabrication and faster decoders does reduce some execution risk relative to prior years. (reuters.com)

Near‑term signs to watch that would meaningfully change the story

- A verified quantum advantage on a problem with clear classical baselines, reproduced by independent groups and published with open benchmarks. IBM signaled intentions here; independent verification is what turns PR into reality. (decrypt.co)

- Demonstrations of much lower logical‑to‑physical qubit overhead for practical codes (e.g., big wins in qLDPC implementations or breakthroughs that shrink physical requirements). (reuters.com)

- Rapid scaling of modular systems that can reliably entangle and operate across multiple error‑corrected modules. That’s the architectural leap from lab demos to machines that could threaten widely used cryptosystems. (postquantum.com)

Practical short checklist (non‑technical)

- Inventory where private keys and long‑lived encrypted data are stored.

- Prioritize migration of the most sensitive keys to PQC‑ready systems when those tools are vetted.

- Follow standards and guidance from NIST and trusted national bodies for PQC rollout timelines. (wired.com)